“Towards a New Bretton Woods: Let the Sober Men Speak” by Paul Mourino (May 19, 2025):

U.S. Treasury Secretary Scott Bessent’s April 21st address at the Institute of International Finance signals the dawn of a new global monetary order. Echoing the original 1944 Bretton Woods Conference, Bessent emphasized a return to sound capitalism grounded in sovereign decision-making, fiscal responsibility, and energy independence. He outlined a vision for updated global financial institutions that promote individual liberty, efficient infrastructure investment, and real economic growth.

Bessent’s remarks stressed a pivotal restructuring of U.S.–China economic relations. For China to engage, it must abandon currency manipulation, state intervention, IP theft, and closed markets. In parallel, the Secretary reaffirmed nuclear energy’s centrality to U.S. economic resurgence, alongside fossil and renewable sources, as the foundation for cheap and abundant energy.

The Financial Policy Council (FPC) situates itself as a nonpartisan forum for economic realism, opposing ideological capture and advocating for principled financial reform. The piece asserts that sound money, national sovereignty, and individual agency must be reinserted into the core of global governance frameworks.

To translate this thesis into investor action, the blog highlights four strategic equities—Palantir (defense analytics), Cameco (nuclear fuel), Brookfield (global infrastructure), and Coinbase (digital currency infrastructure)—as positioned to benefit from Bretton Woods 2.0 dynamics.

In conclusion, the author calls for visionary leadership, institutional clarity, and courageous policymaking to renew the monetary order, restore public trust, and reconnect finance with national purpose.

Wednesday morning, 4.21.25, U.S. Treasury Secretary Scott Bessent addressed a private gathering of Global Bankers in Washington D.C.’s IIF (Institute of International Finance) discussing the next steps forward for renewing the Bretton Woods Institutions (World Bank and the International Monetary Fund) and detailing a return to core operating principles. My fellow Americans, take note of this special moment, it’s an opportunity for renewal, cleansing of the entire system, and robust growth afterwards; therefor seize the moment. CARPE DIEM!

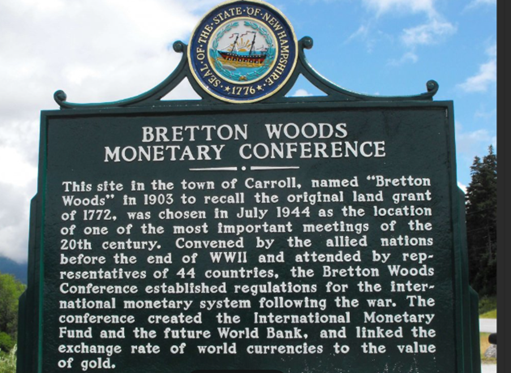

The IMF & World Bank were established to ensure global stability and order among nations in the global financial market, but were they successful? Yes, they did successfully align national interests with the interests of global order during the height of the Cold War (1945-1991). The victory of World War II allowed them, then to come together in New Hampshire’s famous hotel in Bretton Woods to discuss and implement a new global financial architect to manage global affairs in 1944.

Harry Dexter White & Henry Morgenthau (USA), Pierre Mendes (Fra.) and John M. Keynes (UK) were leading voices amongst a gathering of 44 nations who implemented a system which set the dollar as the standard of the global currencies, and fixed the dollar to gold at a specified amount, thus grounding the entire global banking system. Missing from this arrangement of nations were the Warsaw Pact Nations (nation’s aligned with the Soviet Union), and the Non-Aligned Nations (India, China, & many African, South East Asian, & South American nations) This architecture proved effective, during the Cold War era, and first began to experience signs of trouble when President Nixon changed the system’s fundamentals. In August of 1971 President Nixon acted on the guidance of George Schultz and Henry Kissinger to take the dollar off of the gold standard thus allowing for infinite printing of money. Although problematic and worry-some at the time, the system continued to function and it was not until after the fall of the Soviet System in 1991, that things began to unravel. Our leaders from ninety-one’ until to the present have organized the Bretton Woods Institutions around a policy arrangement called ‘Globalization,’ which prescribed laissez faire markets and a system of trade and tariffs, which turned out to be a form of modern-techno-imperialism.

Now with the virtue of the last one hundred days of President Trump and Team Doge’s work, audits and watchdog reports have pointed to systemic inefficiencies and procurement irregularities that undermine public trust in federal spending. Furthermore, a A2023 Government Accountability Office (GAO) report highlighted more than $236 billion in improper payments across federal agencies, raising urgent questions about fiscal discipline and taxpayer stewardship.

Curious minds wish to know if these revelations will be addressed and produce significant changes? Secretary Bessent is saying these institutions will be focused again on capitalism, and business deals designed to promote freedom, individual liberty, and whose profits will generate the necessary revenues to finance government operations. Secretary Bessent emphasized investments in nuclear power and related energy projects will yield an abundance of cheap energy and this will help manifest the economic growth needed.

Continuing on, Secretary Bessent elaborated that America First doesn’t mean American alone… “the United States wants our global partners to participate and buy in… there are 100 nations currently negotiating new trade deals and strategic relations with the United States.” All one hundred nations are necessary, but the key players in the equation are China and the United States’ strategic partners. In short, China must change its industrial export & governance model. There must be material improvements for the average Chinese citizen’s purchasing power domestically along with significant protectors for individual liberty and freedoms. Wow, the Secretary also insists that we will accomplish these reforms together with the following criteria, China must:

These are all monumental changes, and it remains to be seen if Secretary Bessent & President Trumps cabinet can secure a deal on these terms. In truth, remembering the previous attempts at reform by former U.S. Trade Representative Robert Lighthizer (see “Chaos under heaven, Josh Rogan or “Coming China Trade War” by Peter Navarro), during Trump’s first term, 2017-2020. This policy agenda was only derailed after China’s lead negotiator said “No!” and the Wuhan lab’s COVID craziness was unleashed upon the world. God willing, the second time around, will be successful.

Also insightful was Secretary Bessent’s insistence on nuclear power as a necessary policy choice for economic development. He also mentioned a complementary array of investments in fossil fuels and renewal energies where appropriate. In short, projects which provide cheap-abundant energy are the key component to real and robust economic growth. The three remaining items which Secretary Bessent covered during the Q & A were:

Our view here is yes, the dollar will retain its position of privilege as the global reserve currency, with the proviso that an illumination of the associated responsibilities is more clearly articulated to the voting public for review and implementation.

Regarding Europe, they will eventually respond to market demands and increase both their military spending and security posture. European Nations will also make material improvement to their energy policies by necessity. Germany and France have both significantly reduced their production of atomic energy and moving forward we think there’s both great need and opportunities to reverse this policy and build many new nuclear power facilities for commercial and industrial power production.

In the weeks following Secretary’s Bessent’s remarks in Washington , at the Institute of International Finance, a number of bilateral trade deals have been updated and signed. There have been deals signed between the United Kingdom and the United States along with deals between the United States and India, and now in the last few days exciting details coming out about trade deals between the United States and Saudi Arabia.

Before our very eyes. The middle east is transcending the ancient conflicts of tired division of the past, and forging a future where the Middle East is defined by commerce not chaos, where it exports technology not terrorism, and where people of different nations, religions, and creeds are building cities together not bombing each other out of existence. We don’t want that. (loud applause) It’s crucial for the wider world to note, this great transformation does not come from western intervention, nor from people flying in beautiful planes giving you lectures on how to live, and how to govern your own affairs. The gleaming marvels of Riyad and Abu Dubai were not created by Liberal Non-Profits like those who spent trillions of dollars failing to develop Baghdad …Instead the birth of the modern Middle East has been accomplished by the people themselves. The people who have lived here, developing their own sovereign countries, pursuing your own unique visions, and charting your own destinies, in your own way. In the end, the so-called nation builders wrecked far more nation’s then they built, and interventionists were intervening into complex societies, which they did not understand themselves. They claimed to know, but they had no idea… –President Donald Trump to US-Saudi Forum ‘25

Moving forward, the New Bretton Woods system is being reborn and defined by inspired national leadership, national sovereignty, and a people’s internal self-determination. These qualities are combined with a unity of sound technological investment projects, large-scale infrastructure projects & business deals, and all are glued together by strategic self-interests.

It is in this vacuum of moral and institutional courage that the Financial Policy Council asserts its relevance; not as an ivory tower of theoretical abstraction; but as a strategic vanguard of financial realism, economic sovereignty, and policy reconstruction.

The FPC’s leadership understands that our peers, in the think tank-thought leader space, have by and large been either captured by corporate interests or neutered by political fashion. By contrast, we bring to the table something truly rare: uncompromising clarity. We do not cheer for parties; we interrogate policies. We do not traffic in slogans; we build and support principled frameworks; and in the public discourse which is cluttered with half-truths and echo chambers, we position ourselves as a forum for unapologetic candor and unvarnished logic. Be prepared.

The FPC convenes leaders who understand that economic liberty is the precondition for national dignity. We provide an intellectual armory for those willing to challenge: the prevailing orthodoxy’s notion of managed decline. This armory also allows us to see through the illusion of “diversity, equity, and inclusion.” We know that D.E.I. is a mask of confiscatory taxation, which undermines the individual’s industrial sovereignty and self- worth.

Most importantly, the FPC acts not simply as a chronicler of decline, but as a forceful-voice-multiplier for the reconstruction ahead. We synthesize the insights of financial intrapreneurs and entrepreneurs into actionable blueprints that reorients policy around results, responsibility, and renewal.

In this context, the council is not merely an observer of monetary disorder; but an initiator of the conversation that must happen if we are to revive the Bretton Woods system into a healthy framework that restores sound money, real growth, and places human agency at the center of our governing institutions.

If the global economic architecture is to be reset, as this article suggests, then financial markets will not be bystanders. Investors with foresight must evaluate how emerging monetary frameworks, energy sovereignty, and infrastructure nationalism will reorient capital flows. The Bretton Woods of the 21st century will not merely be about central banks, it will involve private capital, sovereign balance sheets, and next-generation economic scaffolding. Here are four actionable investment ideas aligned with that thesis:

1. Palantir Technologies (PLTR); Exchange: NYSE; Sector: Government analytics, defense AI, national infrastructure. Palantir is deeply embedded in the intersection of data security, government systems, and military-intelligence frameworks. In a world shifting toward multipolarity and industrial re-shoring, Palantir’s platforms help governments audit, track, and optimize infrastructure and logistics. As digital sovereignty becomes a national security imperative, firms like PLTR are critical.

Thesis: The new monetary order demands transparency, traceability, and logistical efficiency, Palantir’s core strengths.

2. Cameco Corporation (CCJ); Exchange: NYSE; Sector: Uranium / Nuclear Energy. Cameco is one of the world’s largest producers of uranium. As nations abandon green utopianism in favor of energy realism, nuclear power is being re-evaluated as a reliable base load. The IMF’s climate-linked funding matrix will increasingly reward countries that embrace scalable, clean, sovereign energy.

Thesis: A Bretton Woods 2.0 focused on infrastructure and energy security will drive long-duration demand for uranium.

3. Brookfield Infrastructure Partners (BIP); Exchange: NYSE; Sector: Global infrastructure—transport, energy, data. Brookfield Infrastructure owns and operates essential assets: data centers, railways, pipelines, and terminals. If multilateral institutions are reoriented around real assets and capital investment, as opposed to debt monetization, entities like BIP will be integral to bridging capital deployment with state strategy.

Thesis: Hard infrastructure will replace soft power in global finance; BIP is well positioned.

4. Coinbase Global (COIN); Exchange: NASDAQ; Sector: Digital Asset Exchange. Though regulatory volatility remains a concern, Coinbase stands at the center of digital currency infrastructure in the West. As Bretton Woods 2.0 contemplates the integration, or competition of digital assets, alongside fiat frameworks, COIN represents a “picks and shovels” play in the digitization of money.

Thesis: Dollar resilience may require parallel infrastructure to interact with regulated digital assets; COIN provides that gateway.

Concordant with these big financial changes under consideration, are the necessary legal and judicial improvements to the system…TBD…

Financial Disclaimer The information provided herein is for informational purposes only and does not constitute investment advice, financial guidance, or an offer to buy or sell any securities. The Financial Policy Council and the author do not hold any positions in the securities mentioned at the time of publication. Readers should conduct their own due diligence or consult a registered financial advisor before making any investment decisions. Investing in securities involves risk, including the loss of principal.

Disclaimer: This article discusses certain companies and their products or services as potential solutions. These mentions are for illustrative purposes only and should not be interpreted as endorsements or investment recommendations. All investment strategies carry inherent risks, and it is imperative that readers conduct their own independent research and seek advice from qualified investment professionals tailored to their specific financial circumstances before making any investment decisions.

The content provided here does not constitute personalized investment advice. Decisions to invest or engage with any securities or financial products mentioned in this article should only be made after consulting with a qualified financial advisor, considering your investment objectives and risk tolerance. The author assumes no responsibility for any financial losses or other consequences resulting directly or indirectly from the use of the content of this article.

As with any financial decision, thorough investigation and caution are advised before making investment decisions.